Hi, it’s Thomas from Positive Capital. I’m backing mission-driven entrepreneurs unlocking their business growth potential through M&A and Fundraising advisory. Deal Making Intel is an insider playbook about M&A Deal Making. Today, I’m sharing a playbook for SaaS entrepreneurs.

A few weeks ago I’ve written a piece about getting VCs excited about Marketplace businesses. And then, SaaS founders got jealous. Sorry guys, this one is for you!

The only hack I recommend for closing a Series A is about understanding how people wiring tens of million euros reflect.

Everybody knows venture capital involves pouring funding into start-ups, but few people are actually acquainted with the intellectual process behind investing.

Like all investing activities, VC is about risk management.

For a Series A VC, two fundamental risks must be covered before investing a single dollar.

(1) Market risk

The reason VCs are so obsessed with the size of your market is that you need a large market to reach a critical size without much frictions.

They must see you have reached product-market fit (PMF) in a large TAM.

(2) Execution risk.

Execution risk kicks in when evaluating the ability of your growth engine to blitzscaling. Indeed, a blitzscaling growth engine in a large market will allow a business to ultimately reach a critical size.

It will, except if there are some major operational execution failures. That's why serial entrepreneurs have a better chance to raise funds from VCs as they reduce the execution risk.

All in all, Series A VCs fancy deploying capital in businesses with revenues stream already been derisked. If you don’t show a predictable model, pipeline, and most of all growth, don’t trouble yourself raising.

In summary, companies raising an easy ten million in less than 4 months all share in common 3 things:

Reaching €1,5m ARR within 12 to 24 months (Market risk)

Showing Net Dollar Retention above 100%. (Market risk)

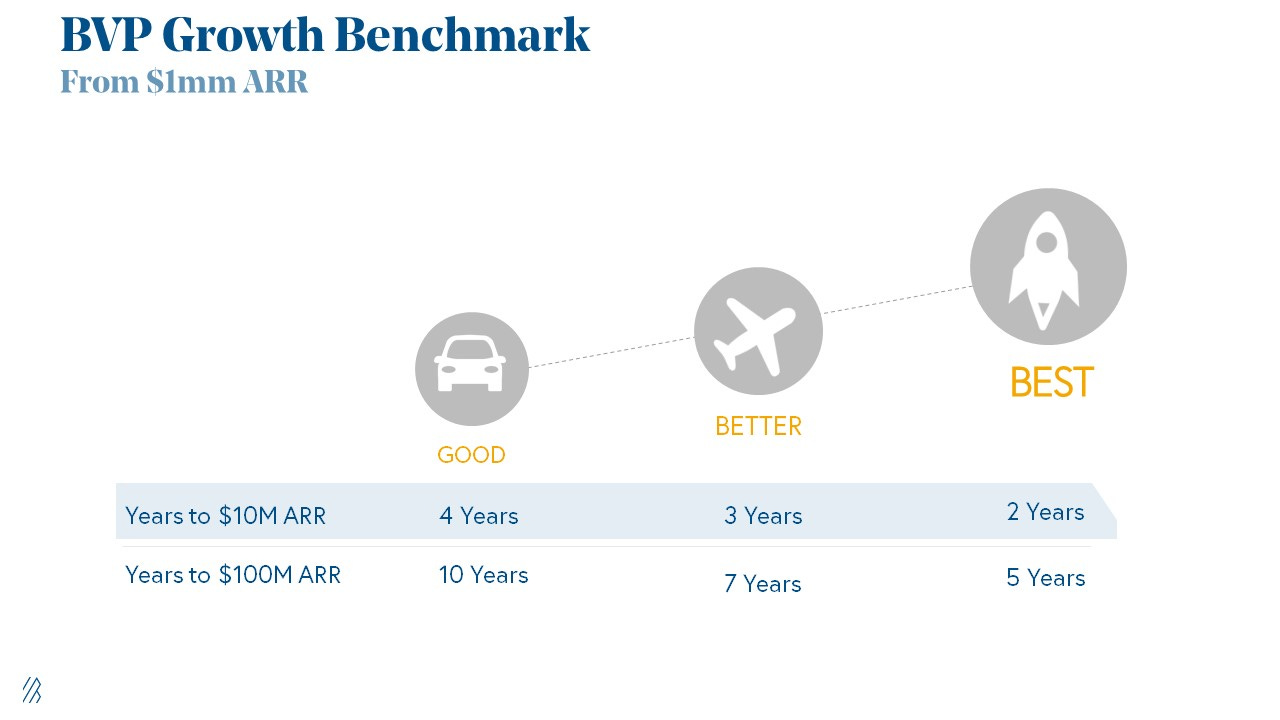

Exhibiting a Lead Velocity Rate supporting €10m ARR in the next 2 to 4 years (Execution risk)

Hit the 3 of them and you will raise an easy ten million in less than 4 months. Highlight 2/3 and discussions might take longer (6–7 months).

If none, don’t bother raising and focus on becoming a capital-efficient business and interesting perspectives will come up (Topics for other posts).

For the brave ones, let’s dive into those 3 metrics.

1. Exhibit a Lead Velocity Rate supporting €10m ARR in the next 2 to 4 years

I am starting with the last one as it’s the least covered metric. However, Lead Velocity Rate (LVR) is, in my opinion, the most reliable data when assessing a growth engine.

One thing every VC love about SaaS is that you can See The Future.

However, common KPI monitored for predicting the futures such as Monthly Sales and Sales Pipelines have major data quality issues. Both are lagging indicators and minor variations can result in huge modeling variations.

If you base your forecasts on lagging indicators, be sure that the VC's financial wizards, aka VC Analysts and VC Associates, will tear down your forecasts.

However, LVR defined as the growth in qualified leads, measured month-over-month, every month, is rock-solid. It’s real-time, not lagging. As long as you are using Qualified Leads, along with using a consistent formula and process for qualifying them, you can See The Future.

With this metric in your hand, scaling your company turns into an execution play on which VCs are able to perform calculations risk.

2. Net Dollar Retention above 100%.

Compared to LVR, Net Dollar Retention is fairly well known as a key metric for assessing the health of a SaaS company.

Net Dollar Retention catches both the ability of a SaaS company to retain customers and sell them more over time. Put differently, ask what €1 of net new customer spend in year n will be worth in years n+1, n+2, and so on.

A SaaS company could be growing ARR over 100% each year but if their annualized Net Dollar Retention is less than 75%, there is likely a problem with the underlying business.

For example, with Slack’s ARR chart (below), you can see how powerful a high Net Retention is. The layer chart shows how revenue from the existing customer base just keeps growing. From its S1, Slack exhibits an insanely 171% 2017–2019 Net Dollar Retention.

3. 1,5m€ in ARR within the previous 12 to 24 months.

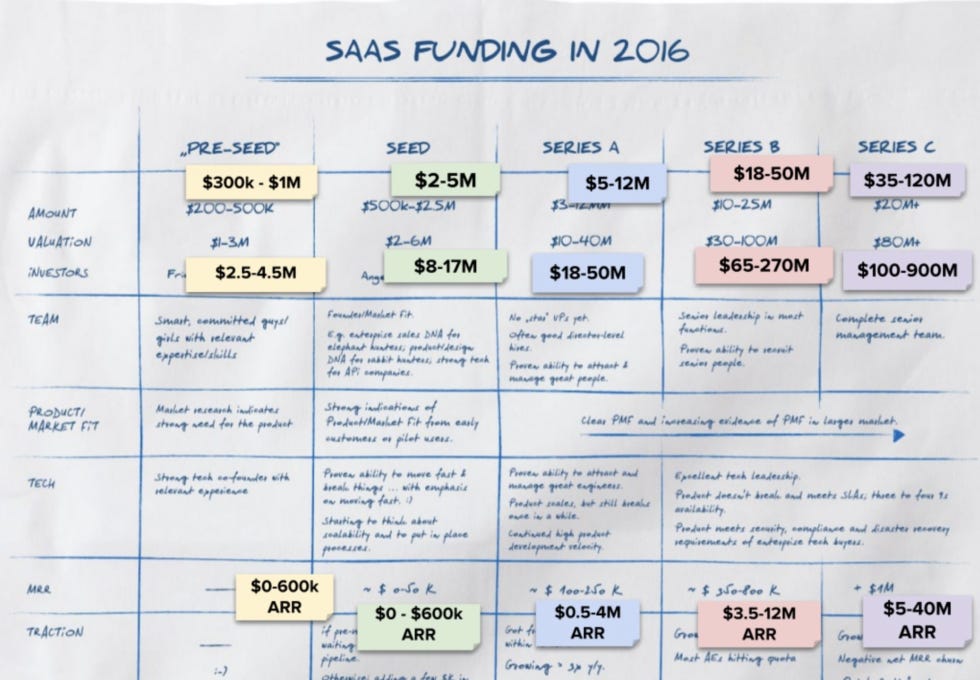

According to Point 9, it takes $0,5m-4m in ARR to raise a $5–12m Series A round, distribution going rather toward the top of the range.

As a rule of thumb, I suggest targeting at least the amount of what you have raised in Pre-Seed/Seed. If you have raised €1,5m since inception, don’t raise before you hit €1,5m ARR.

Since Covid19, capital efficiency has again become predominant. It’s getting harder and harder to request capital with €1m in ARR after having raised 2m€ since inception.

In summary, VCs invest in less than 1% of the companies they meet. Mastering these metrics will help you beat the odds.

If there’s demand for it, I’ll do another post on DTC.

Thanks for reading! If you can relate this Intel to a SaaS founder you know, it’s your duty to share this post ;)

Cheers,

Thanks to Joffrey for the feedback!